In our blog post looking at COVID-19 and the resulting risk ramifications we provided a short list of 9 public company tickers we would be interested in initiating / adding positions in at corresponding entry prices given the dislocation in the market. These were all more or less household names, with well understood business moats, attractive network effects, and margin profiles with the exception of one; MSG. We thought we’d elaborate on the thesis here as there’s a company specific catalyst coming at some point in 2019 that could look to crystalize the value in the form of a spin-off.

Background:

The Madison Square Garden Company or “MSG” is a leader in live experiences comprised of “celebrated venues, legendary sports teams, exclusive entertainment productions, and other entertainment assets which include dining and nightlife venues and music festivals.” The business consists of two operating segments:

· MSG Sports- MSG Sports includes the ownership of the New York Knicks, the New York Rangers, the Hartford Wolf Pack, and the Westchester Knicks. The segment also includes Counter Logic Gaming (“CLG”), a premier North American eSports organization, and Knicks Gaming, MSG’s franchise that competes in the NBA 2K League. In addition, the MSG Sports segment promotes, produces and/or presents a broad array of other live sporting events, including professional boxing, college basketball, college hockey, professional bull riding, mixed martial arts, eSports, and college wrestling

· MSG Entertainment- MSG Entertainment includes concerts, and other live events such as family shows, performing arts and special events — which they present or host in their various venues. Those venues are: Madison Square Garden (“The Garden”), Hulu Theater at Madison Square Garden, Radio City Music Hall, the Beacon Theatre, the L.A. Forum, and The Chicago Theatre. The Entertainment segment also includes Christmas Spectacular Starring the Radio City Rockettes — as well as Boston Calling Events (BCE”), the entertainment production company that owns and operates the Boston Calling Music Festival, and TAO Group Holdings, a hospitality group with globally-recognized entertainment dining and nightlife brands.

Spin-Off:

On June 27, 2018, the Company announced that its BoD has authorized the Company’s management to explore a possible spin-off that would create a separately-traded public company comprised of its sports businesses, including the New York Knicks and New York Rangers professional sports franchises (“Sports SpinCo”). On November 7, 2019 MSG announced a revised plan for the proposed separation of its sports & entertainment businesses at some point during the first quarter of calendar year 2020.

How’d We Get Here:

MSG was established in 2010 when Cablevision spun off the company that consisted of the New York Knicks, New York Rangers, Madison Square Garden, MSG Network, and other entertainment assets. In 2015 in an attempt to close the NAV discount and align shareholder value, the Dolan’s subsequently spun the sports and entertainment assets and that entity retained the MSG name and ticker, while RemainCo consisted of the regional sports network MSG and MSG+ and was called MSG Networks with the ticker “MSGN.”

MSG continues to trade at a significant discount to NAV; by our estimates ~39.5% at last levels due to two primary reasons: 1) Jim Dolan and 2) Conglomerate Structure.

Jim Dolan and the Dolan family control the Class B shares of stock which provide them 10 votes per share vs. the Class A stock and entitle them to elect ~75% of the Board of Directors. In case you’ve been living under a rock (or just don’t follow professional sports) nearly no one likes Jim Dolan. There have been countless articles claiming he’s the worst owner in professional sports, and / or the NBA, while successfully ostracizing his fan base by kicking out former players, and arguing with their most famous . loyal fan, while also believing he himself is a talented musician, not to mention the sexual harassment suit (if this happened today he’d be gone), and FTC violations. The view is that the Dolan family has no intent to sell the teams and as a result “NAV” will never be crystallized, coupled with a lack of path to control from a governance perspective to unlock value.

Often times when public companies have separate & distinct business lines they trade at some semblance of a conglomerate discount. This is especially true when value is predicated upon NAV as opposed to a financial metric (e.g., EBITDA) which is evidenced throughout the various tracking stocks in the Liberty Complex including LSXMA, LBRDK, etc.…. which often trade at ~20–30% NAV discounts vs. the underlying.

Rationale for the Spin:

As part of the strategic rationale the company believes that the proposed separation would “enable shareholders to more clearly evaluate each company’s assets and future prospects.” Separating the sports assets from the venues and entertainment business will provide the marketplace with one of the only pure-play publicly listed sports companies to go along with MANU, BATRA, and FWONK. This creates true scarcity value to an asset class that’s showed the ability to compound in value over time with minimal correlation to the broader market.

The Boston Celtics are owned by Boston Basketball Partners, and Wyc Grousbeck is the lead owner / “governor” of the team. He sat down with the WSJ this week for an interview where he talked about the difference between investing in an NBA team and a startup, but the same logic can be held for a public company as well. He used a common refrain that many in the business of sports discuss:

Consider the top 10 companies in the world — the technology, energy, financial and consumer-goods giants, some with trillion-dollar market caps. Where do they go from here? Consider the fierce competition they each face, as technology and market tastes evolve rapidly and unpredictably. Dozens of serious competitors are coming after them.

Will they all still be around, intact, in 10 years? Twenty years? Will they appreciate from here? Will they be able to hold off the competition? It’s hard to say.

Consider the top 10 sports teams in the world — the iconic teams that are known world-wide, that millions and even billions of global fans can now watch digitally on smartphones. Our leagues and teams are setting new revenue records yearly. The teams build on decades of history and benefit from being part of an organized and cost-controlled league structure. Franchises are strictly limited, digital distribution is growing world-wide, and generations of fans are passing on loyalty to their children.

Will these teams be around, intact, for 10, 20, 30 years to come, still entertaining fans globally? I think so. It feels like a solid bet over the long term.

When Wes Eden and team purchased the Milwaukee Bucks in 2014 everyone thought they were crazy as they paid a “76% premium” the prior Forbes valuation for a team in a “football town” in the 39th largest MSA in the country. Wes & team saw the writing on the wall for the step up in media rights and often characterize the deal as acquiring 1/30th of what they believe to be is one of the most valuable media properties in the world (the NBA).

Sal Galatioto is arguably the top sports investment banker in the world and according to Bloomberg he is raising a $500mn fund to invest in minority interests of Major League Baseball teams. If you listen to Sal on the podcast circuit, you’ll often hear him say “After the age of 15 you’re more likely to change your religion than your favorite professional sports team.” To Wyc’s point about the longevity of these assets you have that same longevity by the fans aka the customers.

All this to say unless you’re a billionaire (and now have billionaire friends or are a deca-billionaire) there’s no path to owning a professional sports team; let alone two. But post spin anyone with a Fidelity or Robinhood account cannot only et access to two professional sports team, but in the #1 MSA in the country where we haven’t seen an outright sale in ~18 years.

NBA Sales: If we look at recent NBA sales they have been done on average / median premium to Forbes Valuation of 64% / 45%. Forbes releases this data on an annual basis piecing together information from league offices, owners, and prospective buyers. This year they ranked the Knicks as the #1 most valuable franchise with an estimated team value of $4.6bn. The last sale was Joe Tsai’s buyout of Mikhail Prokhorov for the Brooklyn Nets for $2.35bn, but this was a minority squeeze transaction given Tsai’s existing ownership and had been pre-negotiated (he just accelerated the timeline). Excluding that deal over the last 5 years the median premium to the prior year’s Forbes Valuation was ~76% and the median EV/S was ~8.2x. Excluding the Nets deal the last time a New York franchise changed hands was the Mets in 2002; showing just how scarce these assets are.

Professional Sports Tailwinds: As the media industry continues to become more and more fragmented sports content remains one of the only draws for live content. Sports average annual domestic national media rights across the MLB, NBA, NFL, and NHL have more than tripled from $4.4bn to $10.0bn over the past 20 years with new negotiations on the horizon. The current NBA media deal was struck in October of 2014 and went into effect during the 2016–2017 season worth a combined $24bn over 9 years (through the ’24-’25 season) which was 2.8x higher than the last deal (~$930mn / year). The league will be negotiating rights in the next ~2 years and given the increased globalization, growing popularity, and the number of streaming platforms vying for live sports content we would expect to see another significant increase for NBA content.

The NHL will be the first professional sports league to have its broadcast rights up for bid as it’ll come due after the 2020–2021 season which pays them $2.0bn over 10 years or ~$200mn / year (this was 2.7x the previous contract). You could expect to see that also significantly increase

All of this will be supported by the further legalization of sports gambling. At present 20 states have legalized gambling in the US so far, with 21 more states having active 2020 legislation on the ballot / docket. The global sportsbook TAM is projected to be $70bn with the US TAM at $20bn alone. Coupled with increased media rights these two tailwinds could see the greatest increase in team valuations to date.

NBA / NHL Fundamentals: We’ve seen significant increase in total revenue for both the NBA & NHL over the past ~15–20 years with NBA revenue topping $8.75bn last year and NHL revenue topping $5.0bn. Notably they were also incredibly resilient during times of economic downturns as their media rights deals are long term, season ticket holders have relatively modest churn, and even in bad times people find discretionary income for sports.

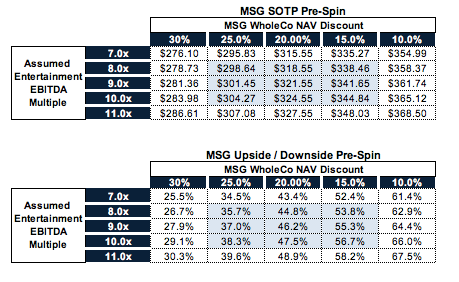

Sum-of-the Parts: The post spin SOTP is fairly straight forward the biggest questions come to the NAV discount ascribed to the more streamlined company.

MSG Sports- The pure play sports company will include:

· New York Knicks- As mentioned above the most recent Forbes Valuation is ~$4.6bn. Given the scarcity value of a professional franchise in NY, let alone the only one that plays in the center of the city we’d expect this to trade at a premium on an EV/S basis. In our base case we use the Forbes estimate for conservative purposes; the below sensitivity table looks at it on both a “fundamental” basis and vs. historical premiums to Forbes valuations.

· New York Rangers- The latest Forbes valuation has the New York Rangers as the most valuable NHL team at an estimated ~$1.65bn. Looking at precedent transactions in the NHL and premiums paid you could realistically support a $2.0bn+ valuation in a bull case scenario. Again for conservative purposes we calibrate our base case scenario to the ~$1.65bn.

· Knicks Gaming- The Sports segment consists of Counter Logic Gaming (“CLG”), a premier North American eSports organization, and Knicks Gaming, MSG’s franchise that competes in the NBA 2K League. CLG and Knicks Gaming are collectively referred to as “their eSports teams.” While eSports is it’s in infancy given the fan base there is likely value accrual potential here as well; we ascribe a de minimums ~$30mn in the base case.

· Greenburgh Training Center- The NYK training center is ~105,000 square feet of space which was built for several million dollars; we ascribe ~$18mn of value

MSG Entertainment

· The Madison Square Garden- “The Garden” also Known As The World’s Most Famous arena was recently appraised by the City of New York for $1.2bn in its latest tax assessment. We use that as our base case.

o Air Rights- Notably we ascribe $0 of value for air rights. BTIG has highlighted this in the past noting they could have between ~1.4mn-3.7mn square feet of air rights at prevailing market values that would equate to ~$479mn-$1.3bn of value. We keep this at $0 given uncertainty around timing / path to monetization.

· Beacon Theatre- In November 2006, they entered into a long-term lease agreement to operate the legendary Beacon Theatre, a venue with approximately 2,800 seats, which sits on the corner of Broadway and 74th Street in Manhattan. The Beacon Theatre is the sixth highest-grossing entertainment venue of its size in the world, based on Billboard Magazine’s 2019 mid-year rankings

· Radio City Music Hall / Christmas Spectacular- One of the Company’s core properties, the Christmas Spectacular — featuring the world-famous Rockettes — has been performed at Radio City Music Hall for 86 years. This accounts for ~$160mn in revenue and is a high margin business. They also have access to Radio City Music Hall with a lease that expires in 2023 with an optional 10-year extension although the Rockette rights are held separate.

· The Chicago Theatre- MSG purchases the 3,600 seat Chicago Theatre in October 2007 for ~$15mn. The Chicago Theatre is the fifth highest-grossing entertainment venue of its size in the world, based on Billboard Magazine’s 2019 mid-year rankings. We grew the purchase price at a ~4–6% rate / year in line with real estate values over that time period.

· LA Forum- In June 2012 they acquired the LA Forum and subsequently spent ~$125mn renovating the building. We grew it at a comparable ~4–6% arriving at a midpoint value of $185mn.

o Notably the LA Times is reporting Steve Ballmer is looking at purchasing the Forum. It could be to destroy it in favor of his new stadium but he’s a motivated buyer either way.

· TAO Group- In 2017 MSG paid $181MM for a 62.5% stake in the Tao Group. TAO Group owns and operates 19 venues in New York City, Las Vegas and Sydney, Australia.

o TAO Group also debuted three new venues in Singapore — Marquee, Avenue, and KOMA.

· MSG Sphere- This is Jim Dolan’s pet project; the company is progressing with its plans to create the “venue of the future” with MSG Sphere, building the first in Las Vegas on a land lease from LVS. Te Company broke ground on the approximately 17,500-seat venue in September 2018 with the start of site preparations, and construction is currently ongoing. Their goal is to open MSG Sphere in Las Vegas in calendar year 2021.

o In February 2018, they announced the purchase of land in Stratford, London, which they expect will become home to the Company’s second MSG Sphere and first large-scale international venue. The Company submitted a planning application to the local planning authority in March 2019.

We don’t ascribe any value to MSG Sphere at this time as it’ll require significant OpEx upfront and not the part of the business we’re interested in post spin.

COVID-19 Concerns: As sporting events, concerts, and conferences are being cancelled in mass live entertainment companies have been hit hard alongside the broader market. Looking at Live Nation (LYV) vs. MSG during the recent selloff they have both underperformed the market by ~11% / ~26% respectively. The difference between the two is the “floor” on MSG given the value of the hard assets in the sports teams / venues in addition to the entertainment business.

Target Value: Putting it all together we get to a total MSG value of ~$8.5-$10.5bn vs. a current enterprise value of ~$4.2bn. Now you still need to ascribe a conglomerate discount and we’re using ~27.5% blended today while taking the sports NAV discount down to ~15% post spin and Entertainment at ~25% post-spin given the simplification pointing to upside to ~$300-$350/share or ~30–50% upside from here. It doesn’t take herculean assumptions to see MSG double over the next ~2–3 years as we have renewed NBA media rights and the chorus of cheers for Jim Dolan continues to grow, even amongst NBA owners.